PayPal has launched PayPal Pay in 3, enabling UK businesses of all sizes to offer buy now, pay later payments without taking on additional risk or paying additional fees.

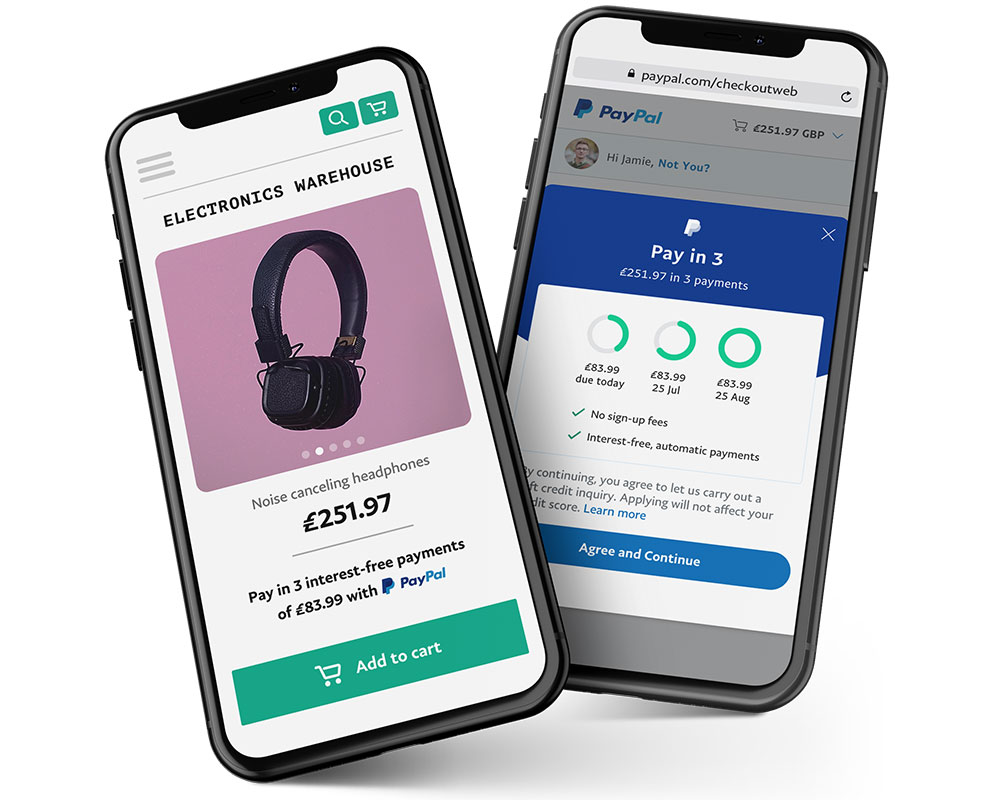

Through PayPal Pay in 3, businesses can offer their customers the option of making purchases between £45 and £2,000 by paying over three interest-free payments, with seamless automatic re-payments each month. PayPal Pay in 3 will also appear in the customer’s PayPal wallet, so they can manage their payments online or via the PayPal app.

The service will help businesses drive checkout conversion, revenue and customer loyalty. Plus, the option is included in the business’s existing PayPal pricing, which means no additional fees. PayPal will pay the business or retailer upfront for the full cost of the purchase.

2019 saw a 39% year-on-year increase in the proportion of buy now, pay later payments in the UK. This trend is forecast to double by 2023.

PayPal Pay in 3 allows companies – from start-ups to globally recognised retailers – to adapt to this changing consumer behaviour. Retailers including Crew Clothing, French Connection, Robert Dyas and Ryman are integrating the service, which is available in the UK from late October 2020.

Commenting is Rob Harper, UK director of enterprise accounts at PayPal. “During the coronavirus pandemic, we have seen the number of people in the UK shopping online increase dramatically. At the same time, many more consumers are looking to spread the cost of those purchases.

“We have developed PayPal Pay in 3 to meet that need. Building on our heritage as a responsible lender through PayPal Credit, which we launched in the UK in 2014, and has served more than two million customers to date.

“We will continue to support UK retailers and businesses through these challenging times; helping them adapt to changing consumer behaviours around how they shop and pay. Especially in the lead up to Black Friday and Christmas.

“PayPal Pay in 3 offers a flexible way for over 24 million PayPal users to shop while providing companies with a tool that helps drive sales, loyalty and customer choice.”

Businesses can learn more about PayPal Pay in 3 and register interest here.