Parents Insights, the UK’s only online data portal specifically designed to provide insights on parents in the UK, reveals its latest findings on Gen Z parents.

Parents Insights recently issued its latest Leisure Measure report focusing on the offline lives of parents. This ranges from expecting mothers through to those raising babies and toddlers up to age 4.

The report examines the data collected by surveying 2,500 parents over the preceding 12-weeks; assessing how they spend their time, what they enjoy doing and what they are currently consuming.

Generation Z (those born after 1995), like their parents, is a generation of consumers whose lives are filled with advertising.

But for retailers, oddly enough, it is more difficult to make money on Gen Z than on their parents. Unlike the X and Y generations, Gen Z takes a lot of time from the moment of choosing a product through to its purchase.

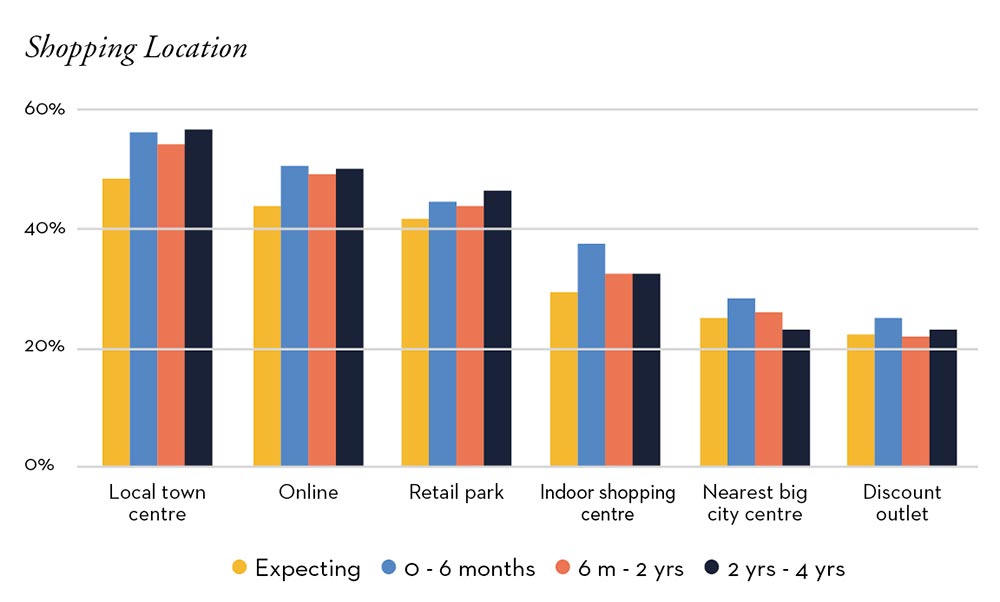

Since the last Leisure Measure report, the percentage of parents shopping in local town centres has been dwindling. Overall, the number of parents reporting to shop in local town centres fell by 5.2% to its lowest level of 55%. Furthermore, these younger Gen Z parents are the least likely age group to shop in local town centres, with 45% of under-25s shopping there decreasing by 21% since the last period.

Instead these parents have shifted their spending to other locations. Based on Parents Insights’ data, discount outlets have increased by 25% with under-25s who cite “getting the best prices” as outlet shopping’s most appealing factor. Online shopping has also increased in popularity for Gen Z parents; from 29% for August to October 2018, to 37% now. Convenient shopping hours being one of the main pulling factors. However, overall, online shopping still ranks behind the local town centre as a shopping destination (36%).

Offline retailers are trying to consider the habits of Gen Z.

Many offline retailers no longer object to the actual transformation of their stores into showrooms with pop up events, where young people come to see, touch and review items they’ve seen online. For the purchase to be completed, retailers open online stores; allowing them to purchase goods through fashionable, digital technologies.

As we draw towards the Christmas trading period, town centres could look to attract sales from Gen Z parents by playing to their key strength for this demographic; good transport links and easy accessibility, for which they outrank all other shopping destinations. Alternatively, smaller town centres could challenge city centres by increasing their offering of restaurants and live events.

This is a brief snapshot of Parent Insights’ capabilities. However, it’s clear the attitudes, behaviours and consumption of young parents are changing significantly. Parents Insights is offering brands an immersive planning meeting to illustrate how data and insights can help inform advertising, content, licensing, product and marketing planning for 2020.

To download a complimentary Parents Insights report, visit www.parentsinsights.com/CWB or to organise a meeting please call 0330 159 6631.